Go back

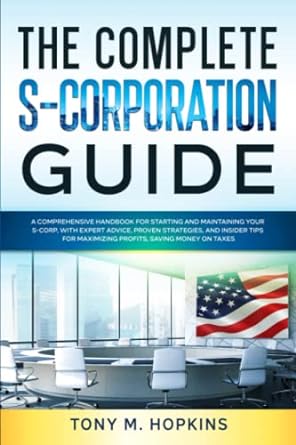

The Complete S Corporation Guide A Comprehensive Handbook For Starting And Maintaining Your S Corp With Expert Advice Proven Strategies Insider Tips For Maximizing Profits Saving Money On Tax(1st Edition)

Authors:

Tony M. Hopkins

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 03, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $68.00

Savings: $68(100%)

Book details

ISBN: 979-8391177791

Book publisher: Independently published

Get your hands on the best-selling book The Complete S Corporation Guide A Comprehensive Handbook For Starting And Maintaining Your S Corp With Expert Advice Proven Strategies Insider Tips For Maximizing Profits Saving Money On Tax 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

The Complete S Corporation Guide A Comprehensive Handbook For Starting And Maintaining Your S Corp With Expert Advice Proven Strategies Insider Tips For Maximizing Profits Saving Money On Tax 1st Edition Summary: IF YOU WANT TO BE YOUR OWN BOSS, LEARN CUTTING-EDGE TACTICS FROM THE EXPERTS TO LAUNCH AN S-CORP IN A CLEAR AND STRAIGHTFORWARD WAY, AND KEEP MORE OF YOUR HARD-EARNED MONEY BY REDUCING YOUR TAX BURDEN. Are you ready to take control of your destiny as a business owner but overwhelmed by the prospect of starting and managing your own company? Serial entrepreneur and tax strategist Tony M. Hopkins is here to alleviate your concerns and provide you with practical solutions to common entrepreneurial problems, with this ultimate blueprint for achieving your goals through the smartest business structure available: the S-Corporation.My book will take you by the hand and guide you through every single step of setting up an S-Corp, from understanding the benefits and drawbacks of this structure to navigating the legal and financial requirements with ease. Starting an S-Corp can provide valuable protection for your assets, pass-through taxation, and numerous other tax loopholes - but only if you do it right! With my book as your guide, you'll learn successful strategies and avoid the pitfalls plaguing so many business owners.Let’s look what you’ll find in my book:The Untapped Power of S-Corporations: Discover the unique advantages S-Corps offer over other business structures and how they can transform your entrepreneurial journey.S-Corp vs. LLC: Unveil the crucial differences and find the perfect fit for your business needs.How to Determine if an S-Corp is appropriate for your business and what alternative business vehicles you may utilize instead to construct your ideal business.A Step-by-Step Guide to Launching Your S-Corp: Your one-stop solution to starting your dream business with ease and confidence, no matter where you are in the US.Save Thousands on Taxes and Successful Accounting Techniques: Master the art of minimizing your tax burden and keeping more of your hard-earned money.When you should engage an accountant and how can you make his work as easy as possibleHow to manage payroll in order to avoid double taxation and save thousands of dollars each yearHow to use the S-Corporation tax loophole to avoid paying self-employment taxes.Avoid Costly Mistakes: Learn the TOP 9 mistakes to sidestep and how to prevent them, ensuring your business stays on the right side of the law.Why 58% of businesses fail in their first five years, and how you may prepare your S-Corp and entrepreneurial mentality to prosper for future DECADES.28 business guidelines that will provide a solid structural basis for your companyHow to calculate "fair pay" so the IRS doesn't flag your companyHow to fund your S-Corp without incurring mountains of unanticipated debtHow to break down your finances for an S-CorpMaximize Shareholder Distribution: Uncover the ultimate strategy to reward your shareholders and grow your business.Unlock Personal Tax Breaks: Reap the benefits of 4 exclusive tax breaks for small business owners like you.Expert Advice for Success: Practical tips, real-life examples, and invaluable insights to guarantee the success of your S-Corp.How to easily Dismiss your S-Corp…& Much More!YOU WILL ALSO FIND A 2 BONUS SECTION INCLUDING THE FOLLOWING TOPICS: 25 Productivity Ideas to Boost Your Business 21 Secrets to Manage Your Time Better and Reach Your Goals EffortlesslyWith expert insights, this book is a must-read for any entrepreneur looking to thrive for decades. Get your book now and learn how to become your own boss while saving a lot of money on taxes!

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request da3tumt

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."