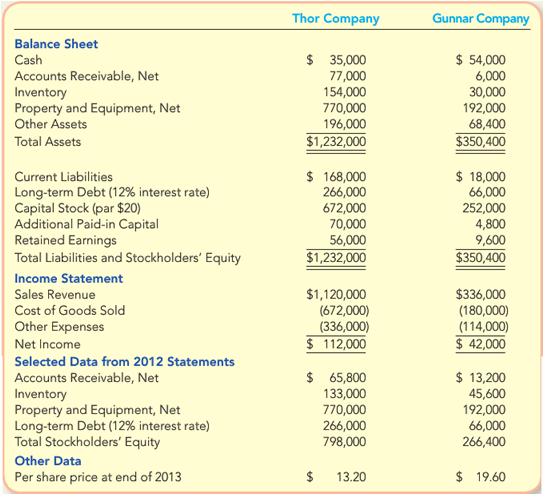

The 2013 financial statements for Thor and Gunnar Companies are summarized here: These two companies are in

Question:

The 2013 financial statements for Thor and Gunnar Companies are summarized here:

These two companies are in the same business and state but different cities. One-half of Thor’s sales and one-quarter of Gunnar’s sales are on credit. Each company has been in operation for about 10 years. Both companies received an unqualified audit opinion on the financial statements. Thor Company wants to borrow $105,000, and Gunnar Company is asking for $36,000.

The loans will be for a two-year period. Neither company issued stock in 2013. Assume the end-of-year total assets and net property and equipment balances approximate the year’s average.

Required:

1. Calculate the ratios in Exhibit 13.5 for which sufficient information is available. Round all calculations to two decimal places.

2. Assume that you work in the loan department of a local bank. You have been asked to analyze the situation and recommend which loan is preferable. Based on the data given, your analysis prepared in requirement 1, and any other information, give your choice and the sup-porting explanation.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0078025518

2nd edition

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips