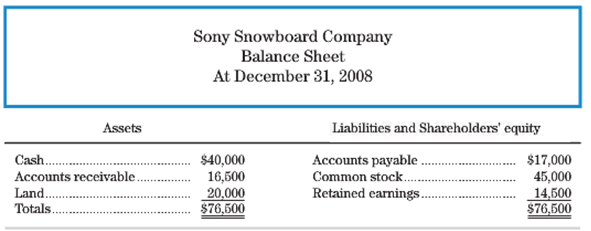

The accounting records for Sony Snowboard Company, a snowboard repair company, contained the following balances as of

Question:

The accounting records for Sony Snowboard Company, a snowboard repair company, contained the following balances as of December 31, 2008:

The following accounting events apply to Sony?s 2009 fiscal year:

a. January 1 The company received an additional $20,000 cash from the owners in exchange for common stock.

b. January 1 Sony purchased a computer that cost $15,000 for cash. The computer had no salvage value and a three-year useful life.

c. March 1 The company borrowed $10,000 by issuing a one-year note at 12%.

d. May1 The company paid $2,400 cash in advance for a one-year lease for office space.

e. June1 The company declared and paid dividends to the owners of $4,000 cash.

f. July1 The company purchased land that cost $17,000 cash.

g. August 1 Cash payments on accounts payable amounted to $6,000.

h. August 1 Sony received $9,600 cash in advance for 12 months of service to be performed monthly for the next year, beginning on receipt of payment.

i. September 1 Sony sold a parcel of land for $13,000 cash, the amount the company originally paid for it.

j. October 1 Sony purchased $795 of supplies on account.

k. November 1 Sony purchased short-term investments for $18,000 cash. The investments pay a fixed rate of 6%.

l. December 31 The company earned service revenue on account during the year that amounted to $40,000.

m. December 31 Cash collections from accounts receivable amounted to $44,000.

n. December 31 The company incurred other operating expenses on account during the year of $5,450.

? Salaries that had been earned by the sales staff but had not yet been paid amounted to $2,300.

? Supplies worth $180 were on hand at the end of the period.

Requirements

1. Prepare an accounting equation worksheet and record the account balances as of December 31, 2008 (beginning balances).

2. Using the worksheet, record the transactions that occurred during 2009 and the necessary adjustments needed at year end. (Based on the given transaction data, there are five additional adjustments [for a total of seven] that need to be made before the financial statements can be prepared.)

3. Prepare the income statement, statement of changes in shareholders? equity, and statement of cash flows for the year ended December 31, 2009, and the balance sheet at December 31, 2009.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Accounts Payable

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting: A Business Process Approach

ISBN: 978-0136115274

3rd edition

Authors: Jane L. Reimers