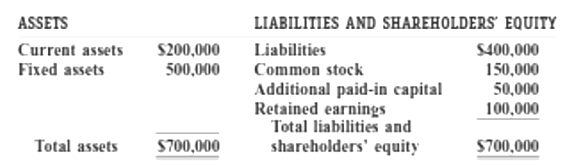

The balance sheet of Natathon International is as follows: Although the balance sheet appears reasonably healthy, Natathon

Question:

The balance sheet of Natathon International is as follows:

Although the balance sheet appears reasonably healthy, Natathon is on the verge of ceasing operations. Appraisers have estimated that, while current assets are worth $200,000, the fixed assets of the company can be sold for only $450,000. There are 1,000 outstanding shares of common stock owned by ten shareholders, each with a 10 percent interest (i.e., 100 shares). before ceasing operations, the board of directors, which is composed primarily of the major shareholders, is considering several alternative courses of action.

1. Liquidate the assets, declare a $250-per-share dividend, and distribute the remaining assets to the creditors.

2. Liquidate the assets, declare a 4400-per-share dividend, and distribute the remaining assets to the creditors.

3. Liquidate the assets, purchase the outstanding shares for $250 each, and distribute the remaining assets to the creditors.

4. Liquidate the assets, and purchase the outstanding shares for $650 each.

Required

(a) Prepare the journal entry to reflect the write-down of the flied assets.

(b) Prepare the journal entry to accompany each alternative course of action.

(c) Comment on the legality of each of the board's proposals, and explain how the assets should he distributed after liquidation.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: