The beta of four stocksG, H, I, and Jare 0.45, 0.8, 1.15, and 1.6, respectively. What is

Question:

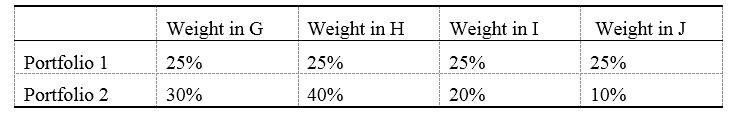

The beta of four stocks—G, H, I, and J—are 0.45, 0.8, 1.15, and 1.6, respectively. What is the beta of a portfolio with the following weights in each asset?

Transcribed Image Text:

Weight in G Weight in J Weight in H Weight in I Portfolio 1 25% 25% 25% 25% Portfolio 2 30% 40% 20% 10%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Beta of Portfolio 1 025 045 025 08 025 115 025 16 portfolio ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

Question Posted:

Students also viewed these Finance questions

-

What is the beta of a portfolio with E( rp) = 18 percent, if rf = 6 percent and E( rM) =14 percent?

-

The beta of four stocksP, Q, R, and Sare respectively 0.6, 0.85, 1.2, and 1.35. What is the beta of a portfolio with the following weights in eachasset? Portfolio1 Portfolio2 Portfolio 3 Weight in P...

-

What is the beta of a portfolio consisting of one share of each of the following stocks given their respective prices and beta coefficients? How would the portfolio beta differ if (a) the investor...

-

Ridge Crest Company has beginning Retained Earnings of $39,000, ending Retained Earnings of $41,500, and a net income of $23,500. What was the amount of dividends declared during the year: $15,500...

-

Write the updating function associated with each of the following discrete-time dynamical systems and evaluate it at the given arguments. Which are linear? t+1 = t/2, evaluate at t = 4, t = 8, and t...

-

Mattel, Inc., is the world's largest manufacturer and marketer of toys, dolls, games, and stuffed toys and animals. Mattel employed Carter Bryant as a product designer from September 1995 through...

-

David Johnson started this business with the aim of making a good living. However, to date he has not paid himself wages or dividends because the business is new and growing. Ultimately the business...

-

Ford Motor (automotive) and Caterpillar (heavy equipment) both use the LIFO inventory valuation method. Caterpillar uses it for 75% of its inventories and Ford for 25% of its inventories. Data from...

-

QUESTION ONE a) Distinguish between sale and agreement to sell b) Explain the rights of unpaid seller against the goods c) Explain the nature of the contract of hire purchase QUESTION TWO (5 marks)...

-

1. What should Theresa put in the marketing segment? What types of information will she need? 2. For the critical risks assessment segment, what key areas does Theresa have to address? Discuss two of...

-

Use the same assets in Problem 23. Could Sally reduce her total risk even more by using Assets M and N only, Assets M and O only, or Assets N and O only? Use a 50/50 split between the asset pairs and...

-

Use the same four assets from Problem 25 in the same three portfolios. What are the expected returns of the four individual assets and the three portfolios, if the current SML is plotting with an...

-

Redtail Co. of Waltham has requested that you prepare journal entries from the following (this company uses the Allowance for Doubtful Accounts method based on the income statement approach): 2012...

-

Your team was assigned to write a report explaining how your company, a medical device manufacturer, can comply with the FDAs regulations and secure premarket approval before Class III devices can go...

-

What sources of factual information for informal reports can report writers consult?

-

Draw a graph to illustrate the U.S. wholesale market for roses. Show the equilibrium in that market with no international trade and the equilibrium with free trade. Mark the quantity of roses...

-

a. If the $5 price described in the news clip were adopted, would the market be efficient or inefficient? Explain. b. Is the $5 price described in the news clip a competitive market price? Explain....

-

Kansas Governor Sam Brownback proposes to raise tobacco taxes from 10 to 20 percent and liquor taxes from 8 to 16 percent. I hope it doesnt happen, said Patti Hoffman of Pattis Wine and Spirits. I...

-

Classify each cation as a weak acid or pH-neutral. (a) C 5 H 5 NH + (b) Ca 2 + (c) Cr 3 +

-

The financial statements of Eastern Platinum Limited (Eastplats) are presented in Appendix A at the end of this textbook. Instructions (a) Does East plats report any investments on its statement of...

-

All of the following costs would be classified as IDC EXCEPT __________. a. Labor to install valves and pipe in the tank battery b. Labor to install the wellhead c. Labor to cement surface casing d....

-

The Rivoli Company has no debt outstanding, and its financial position is given by the following data: The firm is considering selling bonds and simultaneously repurchasing some of its stock. If it...

-

Pettit Printing Company has a total market value of $100 million, consisting of 1 million shares selling for $50 per share and $50 million of 10 percent perpetual bonds now selling at par. The...

-

Beckman Engineering and Associates (BEA) is considering a change in its capital structure. BEA currently has $20 million in debt carrying a rate of 8 percent, and its stock price is $40 per share...

-

A firm that is currently locating facilities in a large number of other countries in order to capitalize on lower production and distribution costs is at what level of global participation?...

-

B of Bombay consigned 400 packages of coffee to K of Kanpur. The cost of each package was Rs. 300. A sum of Rs. 2,000 was paid towards freight and insurance by B. In the transit, 60 packages were...

-

Synopsis In November 1999, ExxonMobil and its CEO Lee Raymond had to determine what course of action to take after two major partners, Royal Dutch/Shell and Frances TotalFinaElf, withdrew from the...

Study smarter with the SolutionInn App