The Byer Corporation, which has a 16 percent after-tax cost of capital, is considering the acquisition of

Question:

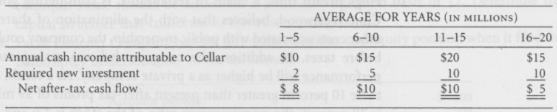

The Byer Corporation, which has a 16 percent after-tax cost of capital, is considering the acquisition of the Cellar Company, which has about the same degree of systematic risk. If the merger were effected, the incremental cash flows would be as follows:

What is the maximum price that Byer should pay for Cellar, assuming the business-risk complexion of the company remains unchanged?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management

ISBN: 9780273713630

13th Revised Edition

Authors: James Van Horne, John Wachowicz

Question Posted: