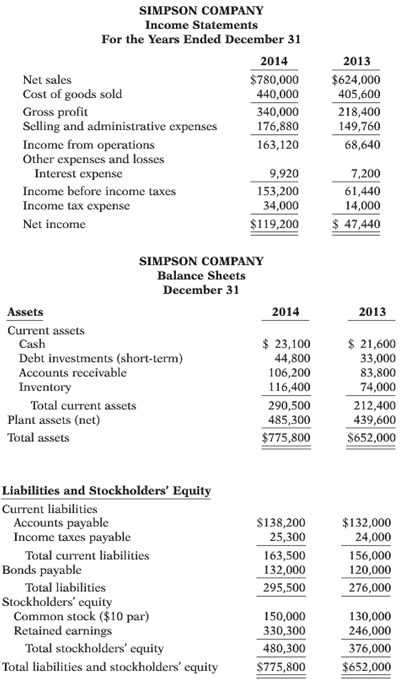

The comparative statements of Simpson Company are shown below. All sales were on account. Net cash provided

Question:

The comparative statements of Simpson Company are shown below.

All sales were on account. Net cash provided by operating activities was $108,000. Capital expenditures were $47,000, and cash dividends were $30,900.

Instructions

Compute the following ratios for 2014.

(a) Earnings per share.

(b) Return on common stockholders’ equity.

(c) Return on assets.

(d) Current ratio.

(e) Accounts receivable turnover.

(f) Average collection period. (g) Inventory turnover.

(h) Days in inventory.

(i) Times interest earned.

(j) Asset turnover.

(k) Debt to assets ratio.

(l) Current cash debt coverage.

(m) Cash debt coverage.

(n) Free cash flow.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Tools for Business Decision Making

ISBN: 978-1118128169

5th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted: