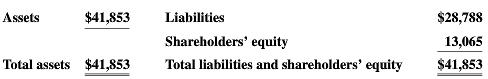

The condensed 2012 balance sheet of Honeywell International follows (dollars in millions): 782 million shares of common

Question:

The condensed 2012 balance sheet of Honeywell International follows (dollars in millions):

782 million shares of common stock and no preferred stock were outstanding. The following requirements are independent:

a. Compute the book value per common share.

b. Compute the book value per common share if the company issues 50 million shares of common stock at $32 per share.

c. Compute the book value per common share if the company issues 50 million shares of common stock at $20 per share.

d. Compute the book value per outstanding share of common stock if the company purchases 50 million shares of treasury stock at $32 per share.

e. Compute the book value per outstanding share of common stock if the company purchases 50 million shares of treasury stock at $20 per share.

f. What effect does issuing stock have on the book value of the outstanding shares? Upon what does this effect depend?

g. What effect does purchasing treasury stock have on the book value of the outstanding shares? Upon what does this effectdepend?

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: