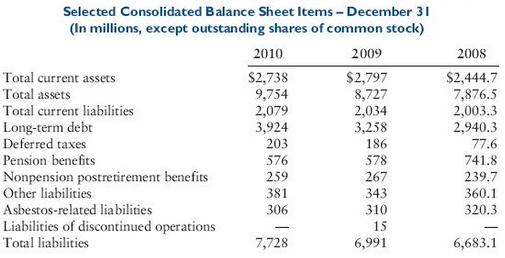

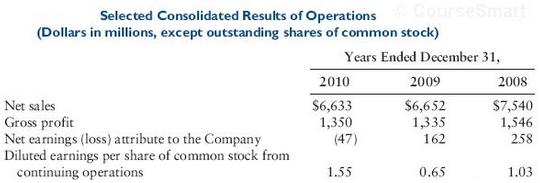

The data in this case come from the 2010 and 2009 annual report of Owens- Illinois.* Note

Question:

The data in this case come from the 2010 and 2009 annual report of Owens- Illinois.*

Note (from 2010 statement 10- K):

Common stock, par value $ 0.01 per share, 250,000,000 shares authorized, 180,808,992 and 179,923,309 shares issued (included treasury shares), respectively. Treasury stock, at cost, 17,093,509 and 11,322,544 shares, respectively.

(This is from the consolidated balance sheet December 31, 2010 and 2009.)

Common stock market price:

December 31, 2010 $ 30.70

December 31, 2009 $ 32.87

December 31, 2008 $ 27.33

a. Compute the following ratios for 2008– 2010:

1. Current ratio

2. Debt ratio

3. Gross profit margin

4. Operating cash flow/total debt

b. Comment on the ratios in (a)

c. Asbestos- related

1. For the three- year period 2008– 2010, how much was recognized in expense for asbestos- related costs?

2. For the three- year period 2008– 2010, how much was paid for asbestos- related payments?

3. Why is there a difference between the expense and the cash payments for asbestos-related payments for the period 2008– 2010?

4. Compute by year (2008– 2010) the impact that asbestos charges (expense and payments) had on net cash provides ( used) in operating activities.

d. 1. Compute the total capitalization for 2010 and 2009 (outstanding shares of common stock X market price).

2. Compare the total shareowners’ equity related to common stock, with the capitalization. Comment on the difference.

Par ValuePar value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Financial Reporting and Analysis Using Financial Accounting Information

ISBN: 978-1133188797

13th edition

Authors: Charles H. Gibson