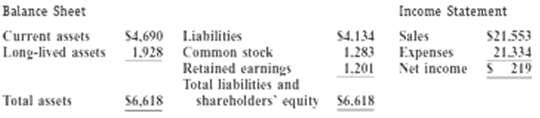

The December 31, 2008, balance sheet and the income statement for the period ending December 31 for

Question:

The December 31, 2008, balance sheet and the income statement for the period ending December 31 for Manpower, Inc., a world leader in staffing and workforce management solutions, follow (dollars in millions). This problem requires knowledge of present value, Refer to Appendix A.)to pay for it. What assumptions and/or principles of financial accounting are importanthere?

You are interested in purchasing Manpower and have ana1yd the future prospects of the company, estimating that it should be able to maintain at least its current earnings amount for the next ten years, at which time the assets would be worthless. You also estimate that the discount rate over that time period will be 12 percent.REQUIRED:a. Assuming that net income is equal to cash inflows, how much should you be willing to pay for Manpower?b. What is the book value of Manpower?c. Explain why there is a difference between the book value of Manpower and the amount you are willing

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer: