The December 31, 2015, balance sheet of the GAB LLP reads as follows: Capital is not a

Question:

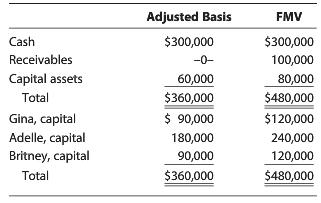

The December 31, 2015, balance sheet of the GAB LLP reads as follows:

Capital is not a material income-producing factor for the LLP. Gina is an active (general) partner and owner of a 25% interest in the LLP’s profits and capital. On December 31, 2015, Gina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Gina’s outside basis for the partnership interest immediately before the distribution is $90,000.

a. How much is Gina’s recognized gain from the distribution? What is the character of the gain?

b. How much can GAB claim as a deduction?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young