The FASB has carefully avoided the issue of discounting deferred taxes. SFAS No. 109 , Accounting

Question:

The FASB has carefully avoided the issue of discounting deferred taxes. SFAS No. 109 , “ Accounting for Income Taxes,” states: a deferred tax liability or asset should be recognized for the deferred tax consequences of temporary differences and operating loss or tax credit carry forwards. . . . Under the requirements of this Statement: . . . Deferred tax liabilities and assets are not discounted.

Required:

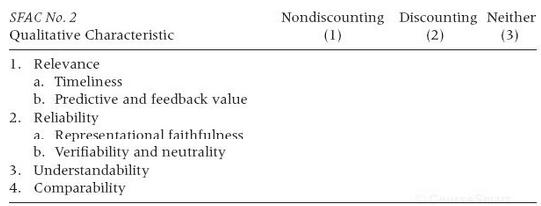

a. Assuming that the firm’s deferred tax liabilities exceed its deferred tax assets, select the approach to measurement, discounting, or non-discounting that is best supported by the qualitative characteristics of SFAC No. 2 by placing an X in the evaluation matrix under the measurement approach selected. For example, if you feel that discounting has higher representational faithfulness, put an X under column 2 beside representational faithfulness. Column 3 is provided for cases for which a given concept is not applicable.

b. Discuss the reasons for your evaluations.

c. Present arguments supporting the discounting of deferred taxes.

d. Present arguments opposing the discounting of deferred taxes.

Step by Step Answer:

Financial Accounting Theory and Analysis Text and Cases

ISBN: 978-1118582794

11th edition

Authors: Richard G. Schroeder, Myrtle W. Clark, Jack Cathey