The finance director of Park plc is preparing financial plans and different departments have submitted a number

Question:

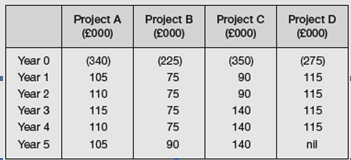

The finance director of Park plc is preparing financial plans and different departments have submitted a number of capital investment applications. The managing director has said that no more than £1m is available for new investment projects. Cash-flow forecasts from the capital investment applications are as follows:

The cost of capital of Park plc is 15 per cent per year.

(a) Determine the optimum investment schedule and the net present value of the optimum investment schedule, if investment projects are divisible but not repeatable.

(b) Determine the optimum investment schedule and the net present value of the optimum investment schedule, if investment projects are not divisible and not repeatable.

(c) Discuss the reasons why the managing director of Park plc may have limited the funds available for new investment projects at the start of the next financial year, even if this results in the rejection of projects which may increase the value of the company.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Corporate Finance Principles and Practice

ISBN: 978-1292103037

7th edition

Authors: Denzil Watson, Antony Head