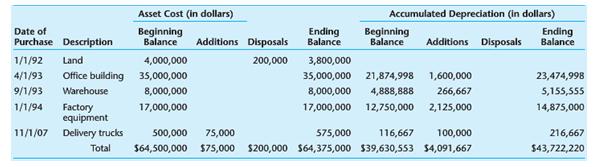

The fixed asset schedule for BCS Manufacturing at December 31, 2011, follows. Buildings are depreciated over thirty

Question:

The fixed asset schedule for BCS Manufacturing at December 31, 2011, follows.

Buildings are depreciated over thirty years. Factory equipment is depreciated over eight years, and trucks are depreciated for five years. The company uses straight-line depreciation with no salvage value and calculates monthly depreciation. The new delivery truck was purchased on November 1, 2011. On March 1, 2011, the land was sold for $8,000,000. The client recognized a gain of $7,800,000 on the sale of the land. You have been assigned to audit this schedule at year-end.

a. What is the balance for fixed assets shown on the balance sheet prepared by the client? In other words, what is the balance for which you are gathering evidence to support or correct?

b. Describe the audit procedures necessary to determine whether the ending balances are correct.

c. Perform the review needed to arrive at a decision regarding the balances. Do you think the client’s calculations are accurate?

d. Evaluate the gain or loss recognized by the client for the asset disposals.

e. Propose the adjusting entry needed to correct the accounts.

f. What balance will be reported on the balance sheet if the proposed audit adjustments are recorded?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Auditing and Assurance Services An Applied Approach

ISBN: 978-0073404004

1st edition

Authors: Iris Stuart