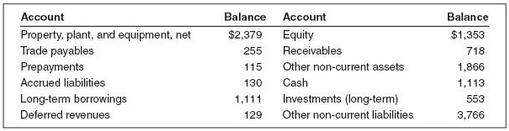

The following are several December 31, 2011, account balances (in millions of dollars) from a recent annual

Question:

The following are several December 31, 2011, account balances (in millions of dollars) from a recent annual report of Canada Post Corporation, followed by several typical transactions. The corporation's vision is described in the annual report as follows: Canada Post will be a world leader in providing innovative physical and electronic delivery solutions, creating value for our customers, employees, and all Canadians.

These accounts have normal debit or credit balances, but are not necessarily in good order. The following hypothetical transactions (in millions of dollars) occurred the next month (from January 1, 2012, to January 31, 2012):

a. Provided delivery service to customers, receiving $ 564 in trade receivables and $ 60 in cash.

b. Purchased new equipment costing $ 540; signed a long- term note.

c. Paid $ 74 in cash to rent equipment, with $ 64 for rental this month and the rest for rent for the first few days in February.

d. Spent $ 396 in cash to maintain and repair facilities and equipment during the month.

e. Collected $ 675 from customers on account.

f. Borrowed $ 90 by signing a long- term note (ignore interest).

g. Paid employees $ 279 earned during the month.

h. Purchased for cash and used $ 49 in supplies.

i. Paid $ 184 on trade payables.

j. Ordered $ 72 in spare parts and supplies.

Required

1. Set up T-accounts for the preceding list and enter the respective balances. (You will need additional T-accounts for statement of earnings accounts.)

2. For each transaction, record the effects in the T- accounts. Label each by using the letter of the transaction. Compute ending balances.

3. Show the effects (direction and amount) of each transaction on net earnings and cash.

4. Prepare in good form a statement of earnings for January 2012.

5. Prepare in good form a classified statement of financial position as at January 31, 2012.

6. Prepare the operating activities section of the statement of cash flows for January 2012, and explain the difference between the cash flow from operating activities and the net earnings computed in (4).

7. Compute the company's total asset turnover ratio and its return on assets. What do these ratios suggest to you about Canada Post? Assume that the long- term note of $ 90 was signed on January 31, and that interest has not accrued yet.

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Financial Accounting

ISBN: 978-1259103285

5th Canadian edition

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M