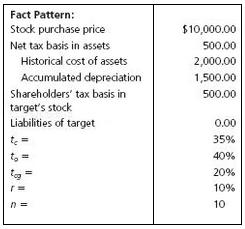

The following facts relate to the purchase of an S corporation and a C corporation. These two

Question:

The following facts relate to the purchase of an S corporation and a C corporation. These two corporations have identical tax bases and are similar in every respect except for their organizational form. The acquirer is willing to pay $ 10,000 to purchase the stock of each corporation.

a. What is the maximum price that an acquirer will pay to acquire the target C corporation in taxable asset sale given that it will pay $ 10,000 in a taxable stock acquisition?

b. What is the maximum price that an acquirer will pay to acquire the target S corporation in taxable stock sale followed by a Section 338(h)(10) election given that it will pay $ 10,000 in a taxable stock acquisition without the election?

c. What is the minimum price that the target’s shareholders will accept under part (a)?

d. What is the minimum price that the target’s shareholders will accept under part (b)?

e. Given your answer to parts (a) and (c), should a taxable asset sale structure be employed in the sale of the C corporation?

f. Given your answers to parts (b) and (d), should the Section 338(h)(10) election be made in the sale of the S corporation?

g. How much more cash after tax can shareholders of the S corporations get, relative to shareholders of the C corporation, assuming the acquirer pays the maximum price that it will pay in a Section 338(h)(10) transaction? The C corporation is sold in a taxable stock sale at $ 10,000 and the S corporation is sold for the price you computed in part (b).

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Taxes And Business Strategy A Planning Approach

ISBN: 9780132752671

5th Edition

Authors: Myron Scholes, Mark Wolfson, Merle Erickson, Michelle Hanlon