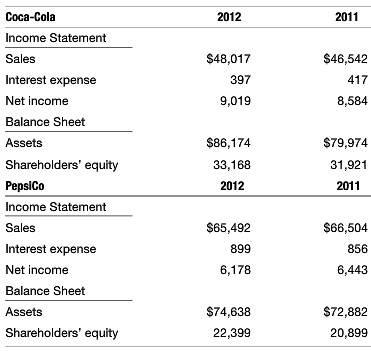

The following information was taken from the financial statements of Coca-Cola and PepsiCo (dollar amounts in millions).

Question:

The following information was taken from the financial statements of Coca-Cola and PepsiCo (dollar amounts in millions). Tax rates for Coca-Cola and Pepsi were 23 percent and 27 percent, respectively.

a. Compute return on equity, return on assets, common equity leverage, capital structure leverage, profit margin, and asset turnover for each company for 2012. Discuss the comparison.

b. For each company, what number results from the following: return on assets × common equity leverage × capital structure leverage?

c. For each company, what number results from the following: profit margin × asset turnover?

d. Compare Coca-Cola to PepsiCo. Which company has the higher return on equity and why? Which company has the higher return on assets and why? Discuss whether the two companies are creating shareholder value.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio. Capital Structure

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Step by Step Answer: