The following information was taken from the statement of shareholders equity of Zielow Siding as of December

Question:

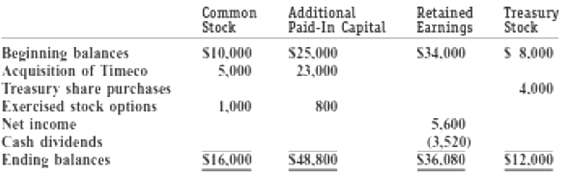

The following information was taken from the statement of shareholders equity of Zielow Siding as of December 31, 2012. The par value of the Zielow stock is $5, and as of the beginning of 2012, the company held 400 shares in treasury.

(a) Zielow issued common stock at one time prior to 2012. How many shares were issued and at what price per share?(b) Zielow purchased treasury stock at one time prior to 2012. How many shares were purchased and at what price?(c) During 2012, Zielow acquired Timeco and issued its own shares as payment in the transaction. How many shares were issued, and what was the market value of Timeco at the time of the acquisition?(d) At what price were the stock options exercised, and how did that price compare to the market value of Timeco at the market value of the acquisition?(e) Compute the per-share dividend rate by Zielow during 2012. Assume that treasury shares acquired in 2012 were purchased at the same price per share prior to 2012.

Par ValuePar value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer: