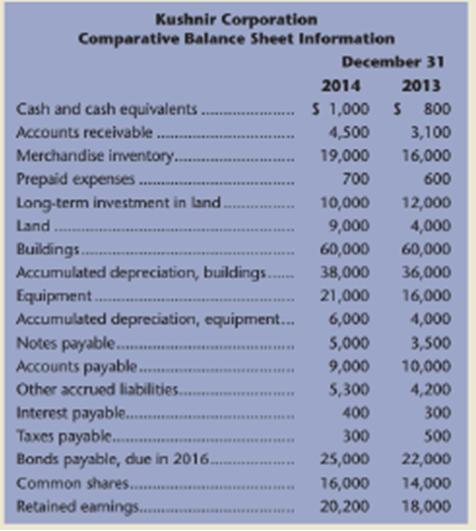

The following items Include the 2014 and 2013 balance sheet information and the 2014 income statement of

Question:

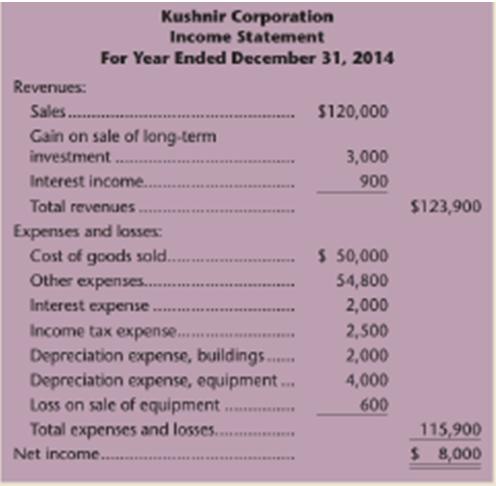

The following items Include the 2014 and 2013 balance sheet information and the 2014 income statement of the Kushnir Corporation. Additional information about the company's 2014 transact is presented after the financial statements.

Additional information:

I. Received 33,000 from the sale of the land Investment that originally cost 52,000.

2. Received $400 cash from the First National Bank on December 31, 2014, as interest income. 3. Sold old equipment for $1,400. The old equipment originally cost $4.000 and had accumulate depredation of $2,000.

4. Purchased land costing 35,030 on December 31, 2014, in exchange for a note payable. Both principal and interest are due on June 30, 2015.

5. Purchased new equipment for 19,000 cash.

6. Paid $5500 of notes payable.

7. Sold additional bonds payable at par of $3,000 on January 1, 2014.

8. Issued 1,000 common shares for cash at S2 per share.

9. Declared and paid a $5,800 cash dividend on October 1, 2014. Required Prepare a statement of rush flows for Kushnir Corporation using the indirect method.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1259066511

14th Canadian Edition

Authors: Larson Kermit, Jensen Tilly