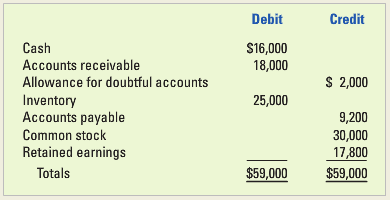

The following post-closing trial balance was drawn from the accounts of Hardwood Timber Co. as of December

Question:

The following post-closing trial balance was drawn from the accounts of Hardwood Timber Co. as of December 31, 2012:

Transactions for 2013

1. Acquired an additional $20,000 cash from the issue of common stock.

2. Purchased $80,000 of inventory on account.

3. Sold inventory that cost $61,000 for $98,000. Sales were made on account.

4. Wrote off $1,500 of uncollectible accounts.

5. On September 1, Hardwood loaned $10,000 to Pine Co. The note had a 6 percent interest rate and a one-year term.

6. Paid $24,500 cash for salaries expense.

7. Collected $99,000 cash from accounts receivable.

8. Paid $78,000 cash on accounts payable.

9. Paid a $5,000 cash dividend to the stockholders.

10. Accepted credit cards for sales amounting to $5,000. The cost of goods sold was $3,500. The credit card company charges a 4% service charge. The cash has not been received.

11. Estimated uncollectible accounts expense to be 1 percent of sales on account.

12. Recorded the accrued interest at December 31, 2013.

Required

a. Record the above transactions in general journal form.

b. Open T-accounts and record the beginning balances and the 2013 transactions.

c. Prepare an income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for 2013.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamental financial accounting concepts

ISBN: 978-0078025365

8th edition

Authors: Thomas P. Edmonds, Frances M. Mcnair, Philip R. Olds, Edward