The following questions are adapted from a variety of sources including questions developed by the AICPA Board

Question:

The following questions are adapted from a variety of sources including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course to study the environment and theoretical structure of financial accounting while preparing for the CPA examination. Determine the response that best completes the statements or questions.

1. Which of the following is not a qualitative characteristic of accounting information according to the FASB’s conceptual framework?

a. Auditor independence.

b. Neutrality.

c. Timeliness.

d. Predictive value.

2. According to the conceptual framework, neutrality is a characteristic of

a. Understandability.

b. Faithful representation.

c. Relevance.

d. Both relevance and faithful representation.

3. The Financial Accounting Standards Board (FASB)

a. Is a division of the Securities and Exchange Commission (SEC).

b. Is a private body that helps set accounting standards in the United States.

c. Is responsible for setting auditing standards that all auditors must follow.

d. Consists entirely of members of the American Institute of Certified Public Accountants.

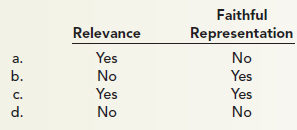

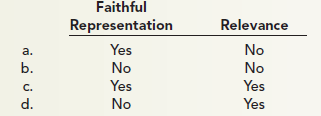

4. Confirmatory value is an ingredient of the primary quality of

5. Predictive value is an ingredient of

6. Completeness is an ingredient of the primary quality of

a. Verifiability.

b. Faithful representation.

c. Relevance.

d. Understandability.

7. The objective of financial reporting for business enterprises is based on

a. Generally accepted accounting principles.

b. The needs of the users of the information.

c. The need for conservatism.

d. None of above.

8. According to the FASB’s conceptual framework, comprehensive income includes which of the following?

Operating Income . Investments by Owners

a. No ........... Yes

b. No ...........No

c. Yes ...........Yes

d. Yes........... No

Beginning in 2011, International Financial Reporting Standards are tested on the CPA exam along with U.S. GAAP. The following questions deal with the application of IFRS.

9. The equivalent to the FASB’s Financial Accounting Standards Advisory Council (FASAC) for the IASB is:

a. International Financial Reporting Interpretations Committee (IFRIC).

b. International Organization of Securities Commissions (IOSCO).

c. International Financial Accounting Advisory Council (IFAAC).

d. Standards Advisory Council (SAC).

10. Which of the following is not a function of the IASB’s conceptual framework?

a. The conceptual framework provides guidance to standard setters to help them develop high quality standards.

b. The conceptual framework provides guidance to practitioners when individual standards to not apply.

c. The conceptual framework includes specific implementation guidance to enable consistent application of particular complex standards.

d. The conceptual framework emphasizes a “true and fair representation” of the company.

11. Late in 2011, the SEC indicated what future direction concerning convergence of U.S. GAAP and IFRS?

a. The U.S. will continue to work with the IASB on convergence efforts, and the SEC will reassess whether adoption of IFRS is appropriate after several more years.

b. The U.S. will follow a “condorsement approach”, whereby the U.S. endorses IFRS standards as they are issued and works to converge existing standards prior to adopting IFRS.

c. The U.S. will continue working on convergence projects with a goal to eventually adopt IFRS, and in the meantime large U.S. companies will be allowed to report under IFRS if they so choose.

d. None of the above.

GAAPGenerally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer:

Intermediate accounting

ISBN: 978-0077647094

7th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson