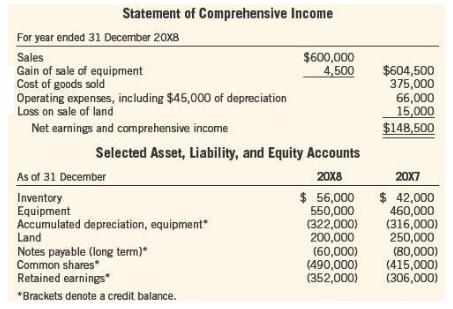

The following selected information is avail-able for Smith & Co. Ltd., for the year ended 31 December

Question:

The following selected information is avail-able for Smith & Co. Ltd., for the year ended 31 December 31 20X8:

Other information:

1. Equipment with an original cost of $ 50,000 was sold for cash.

2. Other equipment was bought for cash.

3. There is no income tax expense.

4. Cash dividends were paid during the year as well as a $ 25,000 stock dividend that reduced retained earnings and increased common shares.

Required:

Present, in good form, the operating, investing, and financing section of the SCF for the year ended 31 December 20X8 as far as possible. Also list the non- cash transactions that would be separately disclosed.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I