The following table repeats the annual total returns on the MSCI Germany Index previously given (see CFA

Question:

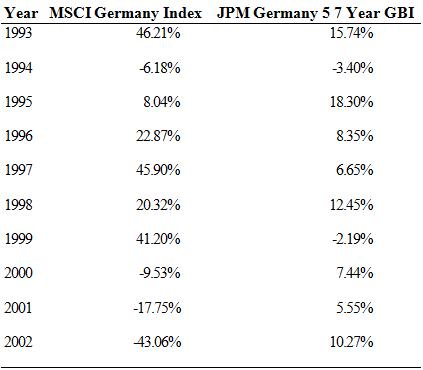

The following table repeats the annual total returns on the MSCI Germany Index previously given (see CFA Question 6-2) and also gives the annual total returns on the JP Morgan Germany 5- to 7-year government bond index (JPM 5—7 Year GBI, for short). During the period given in the table, the International Monetary Fund Ger-many Money Market Index (IMF Germany MMI, for short) had a mean total return of 4.33 percent. Use that information and the information in the table to answer Problems A through C.

a. Calculate the annual returns and the mean annual return on a portfolio 60 percent invested in the MSCI Germany Index and 40 percent invested in the JPM Germany GBI.

b. Using the IMF Germany MMI as a proxy for the risk-free return, calculate the Sharpe ratio for

i. The 60/40 equity/bond portfolio described in Problem A.

ii. The MSCI Germany Index.

iii. The JPM Germany five—seven year GBI.

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: