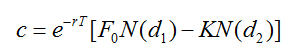

The formula for the price of a European call futures option in terms of the futures price,

Question:

The formula for the price of a European call futures option in terms of the futures price, F0, is given in Chapter 18 as

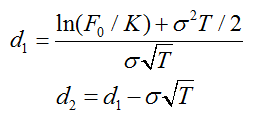

where

and K, r, T, and σ are the strike price, interest rate, time to maturity, and volatility, respectively.

(a) Prove that F0N'(d1) = KN'(d2)

(b) Prove that the delta of the call price with respect to the futures price is e-rTN(d1).

(c) Prove that the vega of the call price is F0 √T N'(d1)e-rT

(d) Prove the formula for the rho of a call futures option given in Section 19.12.

The delta, gamma, theta, and vega of a call futures option are the same as those for a call option on a stock paying dividends at rate q with q replaced by r and S0 replaced by F0. Explain why the same is not true of the rho of a call futures option.

Step by Step Answer: