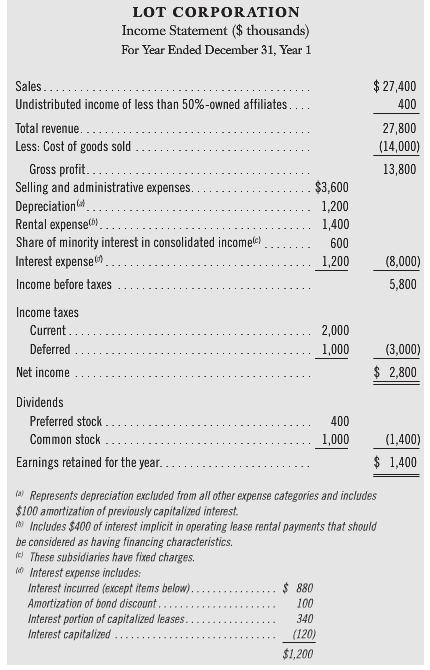

The income statement of Lot Corp. for the year ended December 31, Year 1, follows: Additional Information:

Question:

The income statement of Lot Corp. for the year ended December 31, Year 1, follows:

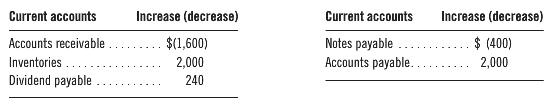

Additional Information:

1. The following changes occurred in current assets and liabilities for Year 1:

2. Tax rate is 40%.

Required:

a. Compute the following earnings coverage ratios:

(1) Earnings to fixed charges.

(2) Cash flow to fixed charges.

(3) Earnings coverage of preferred dividends.

b. Analyze and interpret the earnings coverage ratios in (a).

Transcribed Image Text:

LOT CORPORATION Income Statement ($ thousands) For Year Ended December 31, Year 1 Sales $ 27,400 Undistributed income of less than 50%-owned affiliates. 400 Total revenue. 27,800 Less: Cost of goods sold (14,000) Gross profit... Selling and administrative expenses. Depreciation. Rental expense. Share of minority interest in consolidated incomele) Interest expense 13,800 $3,600 1,200 1,400 600 1,200 (8,000) Income before taxes 5,800 Income taxes Current. 2,000 Deferred 1,000 (3,000) Net income $ 2,800 Dividends Preferred stock 400 Common stock 1,000 (1,400) Earnings retained for the year. $ 1,400 (a Represents depreciation excluded from all other expense categories and includes $100 amortization of previously capitalized interest. Includes $400 of interest implicit in operating lease rental payments that should be considered as having financing characteristics. e These subsidiaries have fixed charges. M Interest expense includes: Interest incurred (except items below). Amortization of bond discount.. Interest portion of capitalized leases. Interest capitalized. $ 880 100 340 (120) $1,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (16 reviews)

a 1 Ratio of Earnings to Fixed Charges Numerator Denominator Pretax income 5800 Int incurred int capitalized 880340120 1100 1220 Amortization of bond ...View the full answer

Answered By

Gauri Hendre

I worked as EI educator for Eduphy India YT channel. I gave online tutorials to the students who were living in the villages and wanted to study much more and were preparing for NEET, TET. I gave tutions for topics in Biotechnology. I am currently working as a tutor on course hero for the biochemistry, microbiology, biology, cell biology, genetics subjects. I worked as a project intern in BAIF where did analysis on diseases mainly genetic disorders in the bovine. I worked as a trainee in serum institute of India and Vasantdada sugar institute. I am working as a writer on Quora partner program from 2019. I writing on the topics on social health issues including current COVID-19 pandemic, different concepts in science discipline. I learned foreign languages such as german and french upto A1 level. I attended different conferences in the science discipline and did trainings in cognitive skills and personality development skills from Lila Poonawalla foundation. I have been the member of Lila poonawalla foundation since 2017. Even I acquired the skills like Excel spreadsheet, MS Office, MS Powerpoint and Data entry.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Financial Statement Analysis

ISBN: 978-0078110962

11th edition

Authors: K. R. Subramanyam, John Wild

Question Posted:

Students also viewed these Managerial Accounting questions

-

The income statement for Delta-tec Inc. for the year ended December 31, 2016, was as follows: Delta-tec Inc. Income Statement (selected items) For the Year Ended December 31, 2016 1 Income from...

-

The following income statement and balance sheets for Virtual Gaming Systems are provided. Earnings per share for the year ended December 31, 2021, are $1.30. The closing stock price on December 31,...

-

In Exercises 912, use the given conditions to write an equation for each line in point-slope form and general form Passing through (4, -7) and perpendicular to the line whose equation is x - 2y - 3 =...

-

Predict the type of solid exhibited by each substance. a. H2S b. Si c. CsF

-

You were in the final stages of your audit of the financial statements of Ozine Corporation for the year ended December 31, 20X2, when you were consulted by the corporations president. The president...

-

Consider the regression models described in Example 8.4. Example 8.4 a. Graph the response function associated with Eq. (8.10). Equation (8.10) b. Graph the response function associated with Eq....

-

How much and in which ways did unbridled self-interest contribute to the subprime lending crisis?

-

1. Consider a situation where your company you are support technician at large corporation. An employee submits "ticket" reporting that they cannot access the internet. Upon further investigation you...

-

Clever, Inc., is a car manufacturer. Its 2018 income statement is as follows: Clever, Inc. Income Statement for the Year Ended December 31, 2018 Sales revenue...

-

The income statement of Kimberly Corporation for the year ended December 31, Year 1, is reproduced below: Additional Information: 1. The following changes occurred in current assets and current...

-

Your supervisor is considering purchasing the bonds and preferred shares of ARC Corp. She furnishes you the following ARC income statement and expresses concern about the coverage of fixed charges....

-

Write the number as a ratio of integers. 2.317 2.3171717... =

-

Knowing that an instrument has been dishonored puts a holder on notice, and the holder cannot become an HDC. (True/False)

-

A bearer instrument is payable to whoever possesses it. (True/False)

-

Why are the correlation coefficients between stock market returns so high?

-

Why have East Asian counties been more efficient in containing the Covid-19 pandemic?

-

National Foods, Inc., sells many kinds of breakfast cereals. Under the Fair Packaging and Labeling Act, National must include on the packages a. the identity of the product only. b. the net quantity...

-

Figure G-13 is a sketch of the profile view of a set of folds exposed in the face of a cliff. First try to visualize the orientations of dip isogons on these folds. Then draw dip isogons at 108...

-

You continue to work in the corporate office for a nationwide convenience store franchise that operates nearly 10,000 stores. The per- store daily customer count (i.e., the mean number of customers...

-

In a certain elaborate roller coaster, the cars are not on tracks but inside a U-shaped track much like a bobsled run. The cars are thus free to swing left and right across the U, climbing the walls...

-

MARU S.A. de C.V., a Mexican corporation that follows IFRS, has elected to use the revaluation model for its property, plant, and equipment. One of MARUs machines was purchased for 2,500,000 Mexican...

-

A financial analyst is analyzing the amortization of a product patent acquired by MAKETTI S.p.A., an Italian corporation. He gathers the following information about the patent: If the analyst uses...

-

An analyst in the finance department of BOOLDO, S.A., a French corporation, is computing the amortization of a customer list, an intangible asset, for the fiscal year ended 31 December 2009. She...

-

1) Based on the stock chart for Michaels Companies Inc, what do you think the short and long-term growth potentials are for this company? (discuss the advantages/disadvantages) Link to the stock...

-

After being drafted in the first round of the NFL draft, a star defensive end invests his signing bonus of $9,827,000.00 in a mutual fund. The fund pays on average 7.00% APR. The player will not...

-

XYZ Co has plans to issue 7,000, Eleven percent Debentures of Rs.100 each at a discount of 5%. The debentures are redeemable after 4 years and the commission payable to brokers & underwriters is Rs....

Study smarter with the SolutionInn App