The job-costing system at Melody's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance,

Question:

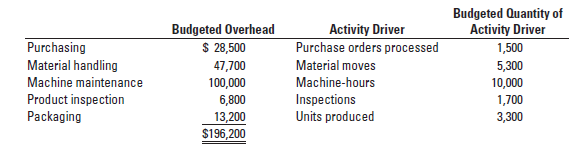

The job-costing system at Melody's Custom Framing has five indirect cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs: Job 220, an order of 17 intricate personalized frames, and Job 330, an order of 5 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect-cost pool and the budgeted quantity of activity driver are as follows.

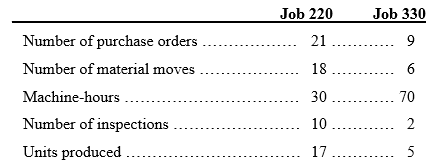

Information related to Job 220 and Job 330 follows. Job 220 incurs more batch-level costs because it uses more types of materials that need to be purchased, moved, and inspected relative to Job 330.

Required

1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on machine-hours.

2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers.

3. Explain why Melody's Custom Framing might favor the ABC job-costing system over the simple job costing system, especially in its bidding process.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 978-0134475585

16th edition

Authors: Srikant M. Datar, Madhav V. Rajan