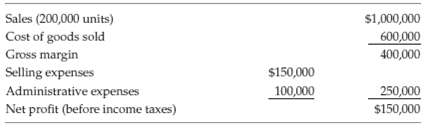

The Monteiro Manufacturing Corporation manufactures and sells folding umbrellas. The corporation's condensed income statement for the year

Question:

The Monteiro Manufacturing Corporation manufactures and sells folding umbrellas. The corporation's condensed income statement for the year ended December 31, 2011, follows:

Monteiro's budget committee has estimated the following changes for 2012:30% increase in number of units sold20% increase in material cost per unit15% increase in direct labor cost per unit10% increase in variable indirect cost per unit5% increase in indirect fixed costs8% increase in selling expenses, arising solely from increased volume6% increase in administrative expenses, reflecting anticipated higher wage and supply price levelsAny changes in administrative expenses caused solely by increased sales volume are considered immaterial. Because inventory quantities remain fairly constant, the budget committee considered that for budget purposes any change in inventory valuation can be ignored. The composition of the cost of a unit of finished product during 2011 for materials, direct labor, and manufacturing support, respectively, was in the ratio of 3:2:1. In 2011, $40,000 of manufacturing support was for fixed costs. No changes in production methods or credit policies were contemplated for 2012.Required(a) Compute the unit sales price at which the Monteiro Manufacturing Corporation must sell its umbrellas in 2012 in order to earn a budgeted profit of $200,000.(b) Unhappy about the prospect of an increase in selling price, Monteiro's sales manager wants to know how many units must be sold at the old price to earn the $200,000 budgeted profit. Compute the number of units that must be sold at the old price to earn $200,000.(c) Believing that the estimated increase in sales is overly optimistic, one of the company's directors wants to know what annual profit is likely if the selling price determined in part a is adopted but the increase in sales volume is only 10%. Compute the budgeted profit in thiscase.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young