The Palm Oil Company buys crude coconut and palm nut oil. Refining this oil results in four

Question:

The Palm Oil Company buys crude coconut and palm nut oil. Refining this oil results in four products at the split-off point: soap grade, cooking grade, light moisturizer, and heavy moisturizer. Light moisturizer is fully processed at the split-off point. Soap grade, cooking grade, and heavy moisturizer can individually be refined into fine soap, cooking oil, and premium moisturizer. In the most recent month (June), the output at the split-off point was:

Soap grade …………… 100,000 gallons

Cooking grade ……….. 300,000 gallons

Light moisturizer …….. 50,000 gallons

Heavy moisturizer …… 50,000 gallons

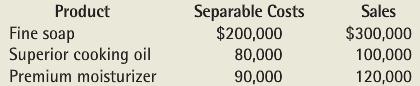

The joint costs of purchasing the crude coconut and palm nut oil and processing it were $100,000. There were no beginning or ending inventories. Sales of light moisturizer in June were $50,000. Total output of soap, cooking oil, and heavy moisturizer was further refined and then sold. Data relating to June are as follows:

Palm Oil Company had the option of selling the soap grade, cooking grade, and heavy moisturizer at the split-off point. This alternative would have yielded the following sales for the June production:

Soap grade ………..… $50,000

Cooking grade ………. 30,000

Heavy moisturizer …… 70,000

REQUIRED

A. Allocate the joint cost using each of the following methods:

(1) Sales value at split-off point,

(2) Physical output,

(3) Net realizable value,

(4) Constant gross margin NRV.

B. Could Palm Oil Company have increased its June operating income by making different decisions about further refining the soap grade, cooking grade, or heavy moisturizer palm nut oil? Show the effect on the contribution margin of any changes you recommend.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott