The president of the retailer Prime Products has just approached the companys bank with a request for

Question:

The president of the retailer Prime Products has just approached the company’s bank with a request for a $30,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loans should be made. The following data are available for the months April through June, during which the loan will be used:

(a) On April 1, the start of the loan period, the cash balance will be $24,000. Accounts receivable on April 1, will total $140,000 of which $120,000 will be collected during April and $16,000 will be collected during May. The remainder will be uncollectible.

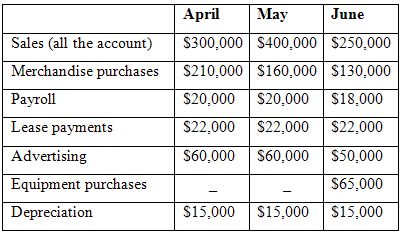

(b) Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% represents bad debts that are never collected. Budgeted sales and expenses for the three-month period follow:

(c) Merchandise purchases are paid in full during the month following purchase. Accounts payable for merchandise purchases during March, which will be paid during April, total $140,000

(d) In preparing the cash budget, assume that the $30,000 loan will be made in April and repaid in June. Interest on the loan will total $1,200.

Required:

1. Prepare a schedule of expected cash collections of April, May and June, and for the three months in total

2. Prepare a cash budget, by month in total, for the three-month period.

3. If the company need a minimum cash balance of $20,000 to start each month, can the loan be repaid as planned? Explain.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer