The purpose of Part I is to perform preliminary analytical procedures as part of the audit planning

Question:

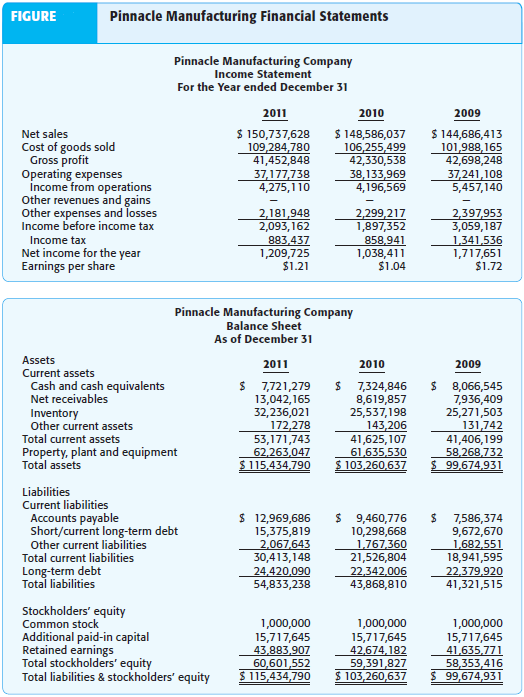

a. Refer to the financial statement data in Figure for the current year and prior two years. Analyze the year-to-year change in account balance for at least five financial statement line items. Document the trend analysis in a format similar to the following:

b. Calculate at least five common ratios shown on page 232-233 and document them in a format similar to the following:

Ratio 2011 2010 2009

Current ratio

c. Based on the analytical procedures calculated in parts a. and b., summarize your observations about Pinnacle's business, including your assessment of the client's business risk.

d. Go to the Pinnacle link on the textbook Web site (www.prenhall.com/arens) and open the Pinnacle income statement, which is located in the Pinnacle Income Statement worksheet of the Pinnacle-Financials Excel file. Use the income statement information to prepare a common-size income statement for all three years. Use the information to identify accounts for which you believe there is a concern about material misstatements. Use a format similar to the following:

Estimate of $ Amount

Account Balance of Potential Misstatement

e. Use the three divisional income statements in the Pinnacle-Financials Excel file on the Web site to prepare a common-size income statement for each of the three divisions for all three years. Each division's income statement is in a separate worksheet in the Excel file. Use the information to identify accounts for which you believe there is a concern about material misstatements. Use a format similar to the one in requirement d.

f. Explain whether you believe the information in requirement d or e provides the most useful data for evaluating the potential for misstatements. Explain why.

g. Analyze the account balances for accounts receivable, inventory, and short/current long-term debt. Describe any observations about those accounts and discuss additional information you want to consider during the current year audit.

h. Based on your calculations, assess the likelihood (high, medium, or low) that Pinnacle is likely to fail financially in the next 12 months.

Step by Step Answer:

Auditing and Assurance services an integrated approach

ISBN: 978-0132575959

14th Edition

Authors: Alvin a. arens, Randal j. elder, Mark s. Beasley