The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it

Question:

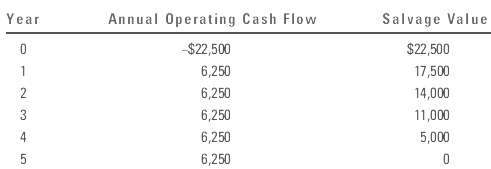

The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given below. The company's cost of capital is 10%.

a. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life?b. Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of aproject?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance A Focused Approach

ISBN: 978-1439078082

4th Edition

Authors: Michael C. Ehrhardt, Eugene F. Brigham

Question Posted: