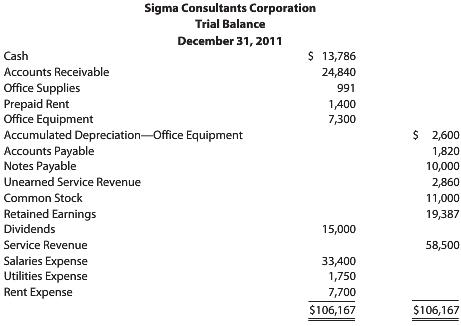

The trial balance for Sigma Consultants Corporation on December 31, 2011, follows. The following information is also

Question:

The trial balance for Sigma Consultants Corporation on December 31, 2011, follows.

The following information is also available:

a. Ending inventory of office supplies, $97.

b. Prepaid rent expired, $500.

c. Depreciation of office equipment for the period, $720.

d. Interest accrued on the note payable, $600.

e. Salaries accrued at the end of the period, $230.

f. Service revenue still unearned at the end of the period, $1,410.

g. Service revenue earned but not billed, $915.

h. Estimated federal income taxes for the period, $2,780.

REQUIRED

1. Open T accounts for the accounts in the trial balance plus the following: Interest Payable, Salaries Payable, Income Taxes Payable, Office Supplies Expense, Depreciation Expense—Office Equipment, Interest Expense, and Income Taxes Expense. Enter the account balances.

2. Determine the adjusting entries and post them directly to the T accounts.

3. Prepare an adjusted trial balance.

4. What financial statements does each of the above adjustments affect? What financial statement is not affected by the adjustments?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: