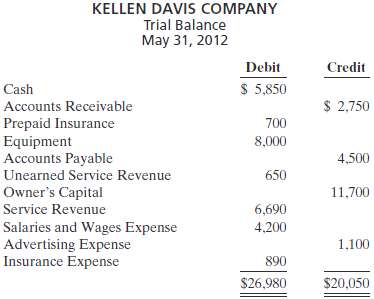

The trial balance of the Kellen Davis Company shown below does not balance. Your review of the

Question:

The trial balance of the Kellen Davis Company shown below does not balance.

Your review of the ledger reveals that each account has a normal balance. You also discover the following errors.

1. The totals of the debit sides of Prepaid Insurance, Accounts Payable, and Insurance Expense were each understated $100.

2. Transposition errors were made in Accounts Receivable and Service Revenue. Based on postings made, the correct balances were $2,570 and $6,960, respectively.

3. A debit posting to Salaries and Wages Expense of $200 was omitted.

4. A $1,000 cash drawing by the owner was debited to Owner?s Capital for $1,000 and credited to Cash for $1,000.

5. A $520 purchase of supplies on account was debited to Equipment for $520 and credited to Cash for $520.

6. A cash payment of $540 for advertising was debited to Advertising Expense for $54 and credited to Cash for $54.

7. A collection from a customer for $210 was debited to Cash for $210 and credited to Accounts Payable for $210.

Instructions

Prepare a correct trial balance. Note that the chart of accounts includes the following: Owner?s Drawings and Supplies.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso