The Tristar Mutual Fund manager is considering an investment in the stock of Best Computer and asks

Question:

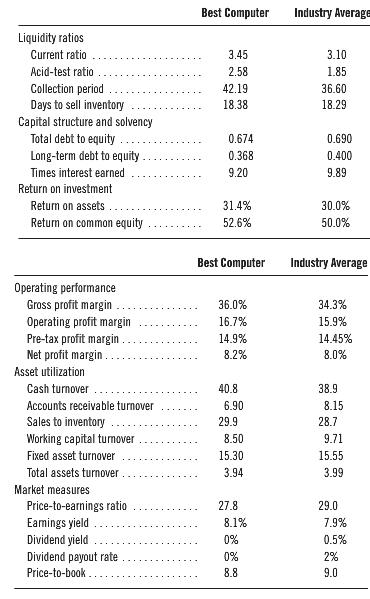

The Tristar Mutual Fund manager is considering an investment in the stock of Best Computer and asks for your opinion regarding the company. Best Computer is a computer hardware sales and service company. Approximately 50% of the company’s revenues come from the sale of computer hardware. The rest of the company’s revenues come from hardware service and repair contracts. Below are financial ratios for Best Computer and comparative ratios for Best Computer’s industry. The ratios for Best Computer are computed using information from its financial statements.

Required:

a. Interpret the ratios of Best Computer and draw inferences about the company’s financial performance and financial condition—ignore the industry ratios.

b. Repeat the analysis in (a) with full knowledge of the industry ratios.

c. Indicate which ratios you consider to deviate from industry norms. For each Best Computer ratio that deviates from industry norms, suggest two possible explanations.

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Step by Step Answer:

Financial Statement Analysis

ISBN: 978-0078110962

11th edition

Authors: K. R. Subramanyam, John Wild