The Vincent Community Hospital balance sheet as of December 31, 2013, follows. Required a. Record in general

Question:

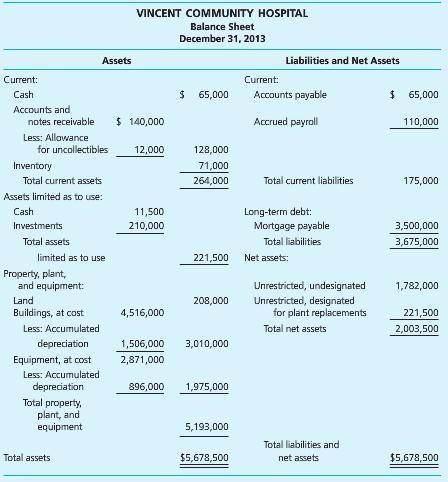

The Vincent Community Hospital balance sheet as of December 31, 2013, follows.

Required

a. Record in general journal form the effect of the following transactions during the fiscal year ended December 31, 2014, assuming that Vincent Community Hospital is a not-for-profit hospital.

(1) Information related to accrual of revenues and gains is as follows:

Patient services revenue, gross $3,500,900

Charity care 107,500

Contractual adjustments to patient service revenues 162,000

Other operating revenues 84,000

(2) Cash received includes:

Interest on investments in Assets Limited as to Use 7,350

Collections of receivables 3,520,600

(3) Expenses of $891,000 were recorded in accounts payable and $1,514,500 in accrued payroll:

Administration expenses 421,600

General services expenses 360,400

Nursing services expenses 938,000

Other professional services expenses 685,500

(4) Cash paid includes:

Interest expense (allocated half to nursing services and half to other professional services) 280,000

Payment on mortgage principal 500,000

Accounts payable for purchases 936,800

Accrued payroll 1,579,500

Transfer to Assets Limited as to Use 30,000

(5) The following information also needs to be recorded for the assets limited as to use:

(a) $10,000 in CDs matured on which $590 in interest was earned.

(b) $30,000 was reinvested in CDs.

(c) $12,300 in equipment was purchased.

(6) Depreciation charges for the year amounted to $117,000 for the buildings and $128,500 for equipment. Depreciation was allocated 40 percent to nursing services, 30 percent to other professional services and 15 percent to each administrative and general services.

(7) Other information:

(a) Provision for uncollectible receivables was increased by $3,800.

The increase was allocated to administrative services.

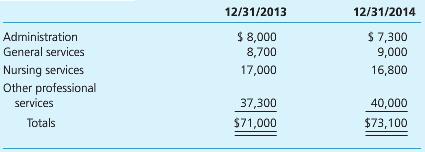

(b) Supplies inventory balances:

(c) Portion of mortgage payable due within one year, $500,000.

(8) A $780 unrealized loss on investments occurred.

(9) Nominal accounts were closed.

(10) Reflecting the net increase in Assets Limited as to Use of $24,860 (see transactions 2, 4, 5, and 8), record the increase in Net Assets—Unrestricted, Designated for Plant Replacement.

b. Prepare a balance sheet as of December 31, 2014.

c. Prepare a statement of operations for the year ended December 31, 2014.

d. Prepare a statement of cash flows for the year ended December 31, 2014.

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-0078110931

16th Edition

Authors: Earl R. Wilson, Jacqueline L Reck, Susan C Kattelus