Titan Truck, Inc., received the following notes during 2016: Requirements: 1. Identifying each note by number, compute

Question:

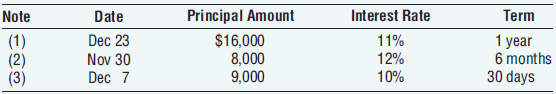

Titan Truck, Inc., received the following notes during 2016:

Requirements:

1. Identifying each note by number, compute the total interest on each note over the note term using a 360-day year, and determine the due date and maturity value of each note. Round interest calculations to the nearest dollar.

2. Journalize a single adjusting entry on December 31, 2016, to record accrued interest revenue on all three notes. Round interest calculations to the nearest dollar. Explanations are not required.

3. For note (1), journalize the collection of principal and interest at maturity. Explanations are not required?

MaturityMaturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: