Toby Ambervilles Manhattan Caf, Inc., is considering investment in two alternative capital budgeting projects. Project A is

Question:

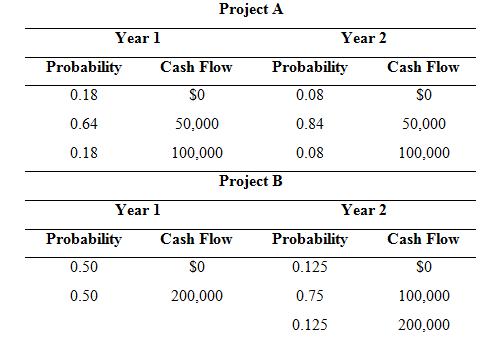

Toby Amberville’s Manhattan Café, Inc., is considering investment in two alternative capital budgeting projects. Project A is an investment of $75,000 to replace working but obsolete refrigeration equipment. Project B is an investment of $150,000 to expand dining room facilities. Relevant cash flow data for the two projects over their expected two-year lives are:

A. Calculate the expected value, standard deviation, and coefficient of variation for cash flows from each project.

B. Calculate the risk-adjusted NPV for each project using a 15% cost of capital for the riskier project and a 12% cost of capital for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank the projects according to the PI criterion.

D. Calculate the IRR for each project, and rank the projects according to the IRR criterion.

E. Compare your answers to parts B, C, and D, and discuss any differences.

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer: