Transfer pricing, utilization of capacity. (J. Patell, adapted) The California Instrument Company (CIC) consists of the semiconductor

Question:

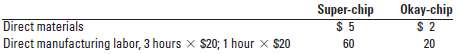

Transfer pricing, utilization of capacity. (J. Patell, adapted) The California Instrument Company (CIC) consists of the semiconductor division and the process-control division, each of which operates as an independent profit center. The semiconductor division employs craftsmen who produce two different electronic components: the new high-performance Super-chip and an older product called Okay-chip. These two products have the following cost characteristics:

Due to the high skill level necessary for the craftsmen, the semiconductor division's capacity is set at 45,000 hours per year. Maximum demand for the Super-chip is 15,000 units annually, at a price of $80 per chip. There is unlimited demand for the Okay-chip at $26 per chip.The process-control division produces only one product, a process-control unit, with the following cost structure:Direct materials (circuit board): $70Direct manufacturing labor (3 hours x $15): $45The current market price for the control unit is $132 per unit.A joint research project has just revealed that a single Super-chip could be substituted for the circuit board currently used to make the process-control unit. Direct labor cost of the process-control unit would be unchanged. The improved process-control unit could be sold for $145.Required1. Calculate the contribution margin per direct-labor hour of selling Super-chip and Okay-chip. If no transfers of Super-chip are made to the process-control division, how many Super-chips and Okay-chips should the semiconductor division manufacture and sell? What would be the division's annual contribution margin? Show your computations.2. The process-control division expects to sell 5,000 process-control units this year. From the viewpoint of California Instruments as a whole, should 5,000 Super-chips be transferred to the process-control division to replace circuit boards? Show your computations.3. What transfer price, or range of prices, would ensure goal congruence among the division managers? Show your calculations.4. If labor capacity in the semiconductor division were 60,000 hours instead of 45,000, would your answer to requirement 3 differ? Show yourcalculations.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0132109178

14th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav