Tricia Corporation exchanged 40,000 previously unissued no par common shares for a 40 percent interest in Lisa

Question:

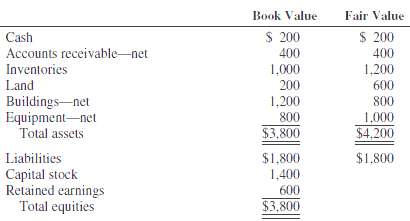

Tricia Corporation exchanged 40,000 previously unissued no par common shares for a 40 percent interest in Lisa Corporation on January 1, 2011. The assets and liabilities of Lisa on that date (after the exchange) were as follows (in thousands):

The direct cost of issuing the shares of stock was $20,000, and other direct costs of combination were $80,000.REQUIRED1. Assume that the January 1, 2011, market price for Tricia's shares is $24 per share. Prepare a schedule to allocate the investment cost/book value differentials.2. Assume that the January 1, 2011, market price for Tricia's shares is $16 per share. Prepare a schedule to allocate the investment cost/book value differentials. Assume that other direct costs were$0.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith