True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a $400,000 taxable loss in its first

Question:

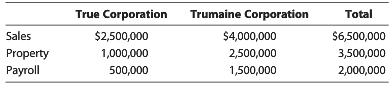

True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a $400,000 taxable loss in its first year of operations. True's activities and sales are restricted to State A, which imposes an 8% income tax. In the same year, Trumaine's taxable income is $1 million. Trumaine's activities and sales are restricted to State B, which imposes an 11% income tax. Both states use a three factor apportionment formula that equally weights sales, payroll, and property, and both require a unitary group to file on a combined basis. Sales, payroll, and average property for each corporation are as follows.

True and Trumaine have been found to be members of a unitary business.

a. Determine the overall state income tax for the unitary group.

b. Determine aggregate state income tax for the entities if they were nonunitary.

c. Incorporate this analysis in a letter to Trumaine's board of directors. Corporate offices are located at 1234 Mulberry Lane, Birmingham, AL 35298.

Step by Step Answer:

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney