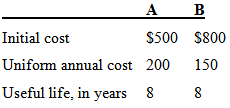

Two alternatives are being considered: Both alternatives provide an identical benefit. (a) Compute the payback period if

Question:

Two alternatives are being considered:

Both alternatives provide an identical benefit.

(a) Compute the payback period if Alt. B is purchased rather than Alt. A.

(b) Use a MARR of 12% and benefit-cost ratio analysis to identify the alternative that should be selected.

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: