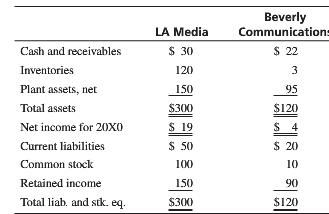

Two Hollywood companies had the following balance sheet accounts as of December 31, 20X0, and net income

Question:

Two Hollywood companies had the following balance sheet accounts as of December 31, 20X0, and net income for 20X0 (in millions):

On January 4, 20X1, these firms merged. LA issued $180 million of its shares (at market value) in exchange for all the shares of Beverly, a motion picture division of a large company. The inventory of films acquired through the combination had been fully amortized on Beverly’s books. During 20X1, Beverly received revenue of $16 million from the rental of films from its inventory. LA earned $20 million on its other operations (i.e., excluding Beverly) during 20X1. Beverly broke even on its other operations (i.e., excluding the film rental contracts) during 20X1.

1. Prepare a consolidated balance sheet for the combined company immediately after the combination. Assume that $80 million of the purchase price was assigned to the inventory of films.

2. Prepare a comparison of LA’s net income between 20X0 and 20X1 where the cost of the film inventories would be amortized on a straight-line basis over 4 years. What would be the net income for 20X1 if the $80 million were assigned to goodwill rather than to the inventory of films and the value of goodwill was maintained?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta