Two textile companies, Meyer Manufacturing and Haugen Mills, began operations with identical balance sheets. One year later,

Question:

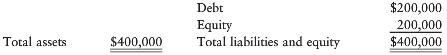

Two textile companies, Meyer Manufacturing and Haugen Mills, began operations with identical balance sheets. One year later, both required additional manufacturing capacity, which could be obtained by purchasing a new machine for $200,000. To raise the needed funds, Meyer issued a five-year, $200,000 bond with a coupon rate equal to 8 percent. Haugen, on the other hand, decided to sell common stock to raise the $200,000. The stock was sold for $50 per share, and the issue increased the number of outstanding, or existing, shares by 20 percent from the pre-issue level. All previous issues of stock were sold for $50 per share also. The balance sheet for each company, before the asset increases, is as follows:

a. Show the balance sheet of each firm after the asset is purchased.

b. How many shares of stock did Haugen have outstanding before the equity issue? How many are outstanding after the issue?

c. With the additional manufacturing capacity provided by the machine, the operating earnings (before taxes and interest payments) of each company will increase by $100,000. How much of this amount could be paid to the shareholders of each company? Assume that the tax rate for both companies is 40 percent.

d. How much of the $100,000 operating earnings could be paid as dividends to each share of stock for each company (i.e., the additional earnings per share)? Assume that both companies had the same number of outstanding shares of stock prior to the purchase of the new machine.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Coupon

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a...

Step by Step Answer: