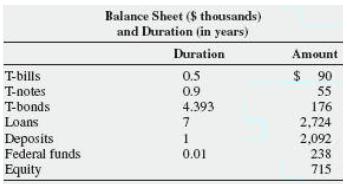

Use the following balance sheet information to answer this question. a. What is the average duration of

Question:

Use the following balance sheet information to answer this question.

a. What is the average duration of all the assets?

b. What is the average duration of all the liabilities?

c. What is the FI’s leverage- adjusted duration gap? What is the FI’s interest rate risk exposure?

d. If the entire yield curve shifted upward 0.5 percent (i. e., ∆R/(1 + R) = 0.0050), what is the impact on the FI’s market value of equity?

e. If the entire yield curve shifted downward 0.25 percent (i. e., ∆R/(1 + R ) = - 0.0025), what is the impact on the FI’s market value of equity?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Markets and Institutions

ISBN: 978-0077861667

6th edition

Authors: Anthony Saunders, Marcia Cornett

Question Posted: