Use the Rolling Hills data from Problem. In Problem, the 2015 income statement and comparative balance sheet

Question:

Use the Rolling Hills data from Problem.

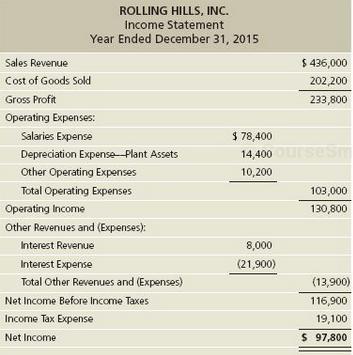

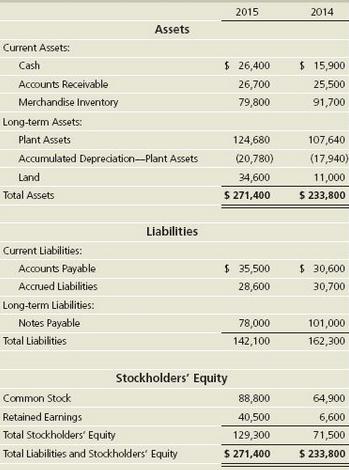

In Problem, the 2015 income statement and comparative balance sheet of Rolling Hills, Inc. follow:

Additionally, Rolling Hills purchased land of $ 23,600 by financing it 100% with long- term notes payable during 2015. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $ 0. The cost and the accumulated depreciation of the disposed asset was $ 11,560.

ROLLING HILLS, INC.

Comparative Balance Sheet

December 31, 2015 and 2014

Requirements

1. Prepare the 2015 statement of cash flows by the direct method.

2. How will what you learned in this problem help you evaluate an investment?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura