Using the corporate tax rate schedule given in Table 2.1, perform the following: a. Find the marginal

Question:

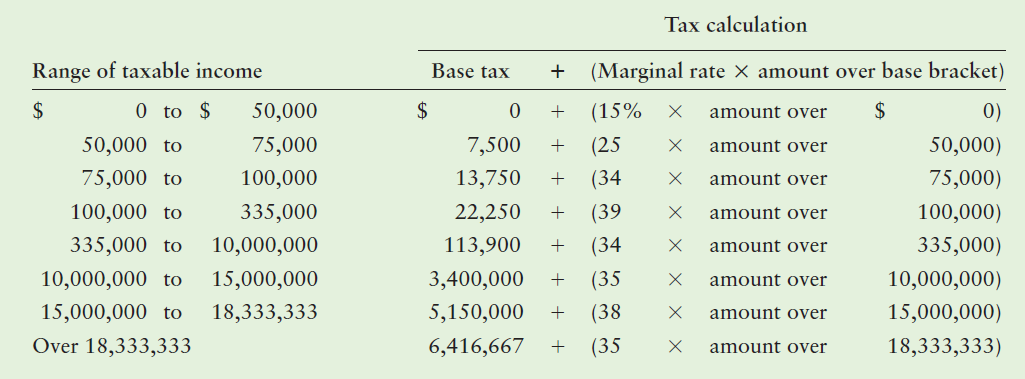

Using the corporate tax rate schedule given in Table 2.1, perform the following:

a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $15,000; $60,000; $90,000; $200,000; $400,000; $1 million; and $20 million.

b. Plot the marginal tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). Explain the relationship between these variables.

Table 2.1

Transcribed Image Text:

Tax calculation Range of taxable income 0 to $ Base tax (Marginal rate X amount over base bracket) 0) amount over (15% (25 50,000 50,000) 75,000) 100,000) 335,000) 10,000,000) 15,000,000) amount over 50,000 to 75,000 7,500 75,000 to amount over 100,000 13,750 (34 amount over 100,000 to 335,000 22,250 (39 (34 amount over 335,000 to 10,000,000 113,900 amount over 10,000,000 to 15,000,000 3,400,000 (35 amount over 15,000,000 to 18,333,333 5,150,000 (38 Over 18,333,333 amount over 18,333,333) 6,416,667 (35

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (17 reviews)

a Tax Calculation Pretax Income Base Tax Amount over Base Total Tax Margi...View the full answer

Answered By

Jeff Omollo

As an educator I have had the opportunity to work with students of all ages and backgrounds. Throughout my career, I have developed a teaching style that encourages student engagement and promotes active learning. My education and tutoring skills has enabled me to empower students to become lifelong learners.

5.00+

5+ Reviews

46+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Finance questions

-

Using the corporate tax rate schedule given in Table, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings...

-

Given the U.S. Corporate Tax Rate Schedule in Exhibit 10.6, what is the marginal tax rate and average tax rate of a corporation that generates a taxable income of $12 million in 2012?

-

Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail Mar. 1...

-

Dent Department Stores Ltd. has just installed new electronic cash registers with scanners in its stores. How do these cash registers improve control activities over cash receipts?

-

ABC corp. issues a 7 year $1,000 face value bond that has an annual coupon rate of 8.44% and pays interest semi-annually. Similar bonds are offering a yield to maturity of 12.9%. What should be the...

-

Blatt Consulting Services is interested in comparing the number of customer accounts managed by its consultants. The chart below is a default chart produced in Excel. a. Which preattentive attributes...

-

Journal entries for dividends. Give journal entries, if required, for the following transactions, which are unrelated unless otherwise specified: a. A firm declares the regular quarterly dividend on...

-

b) Explain what decision-making is (no more than 50 words for each) i) according to the legal context of Anishinaabe nations ii) according to the context of CPA professional standards quoted from...

-

You, CPA, work as a consultant on various engagements. Your client, Over The Edge Ltd. (OTE), has grown from a small custom snowboard manufacturer servicing the local market to a multinational...

-

Using the corporate tax rate schedule given in Table 2.1, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate...

-

During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $490,000. In addition, during the year it received $20,000 in income from interest on bonds it held in...

-

An ideal gas mixture contains 9 kmol of argon and 1 kmol of helium at a total pressure of 100 kPa and a temperature of 25oC. Determine the chemical potential (k) of argon and helium in the mixture.

-

A vessel having a volume of 3 cu ft contains 0.5 lb of air at atmospheric pres- sure. Additional air is forced into the vessel until the total weight of air is 1.375 lb. If the temperature remains...

-

20. As a shaft's journal passes through a plain bearing, one edge of the bearing rubs against the left side of the journal and the other edge rubs against the right side of the journal. The cause of...

-

What type of coordinates determines each new tool position based on the tool's current position? POSSIBLE ANSWERS: O Axial coordinates Polar coordinates Incremental coordinates Absolute coordinates

-

6. Three identical small Styrofoam balls (m = 2.05g) are suspended from a fixed point by three nonconducting threads, each with a length of 45.1cm and with negligible mass. At equilibrium the three...

-

4. Where are revolved sections placed in a print? A. In between section lines B. Cutting planes are used to identify their locations O C. In between break lines O D. Stand-alone

-

Why has Delta Air Lines added a mix of new and used aircraft to its fleet?

-

Assume that your audit team has established the following parameters for the examination of ELM's sales transactions: LO G-3 Risk of incorrect acceptance...

-

In a different language, liro cas means red tomato. The meaning of dum cas dan is big red barn and xer dan means big horse. What are the words for red barn in this language?

-

International investment returns Joe Martinez, a U.S. citizen living in Brownsville, Texas, invested in the common stock of Telmex, a Mexican corporation. He purchased 1,000 shares at 20.50 pesos per...

-

David Talbot randomly selected securities from all those listed on the New York Stock Exchange for his portfolio. He began with a single security and added securities one by one until a total of 20...

-

David Talbot randomly selected securities from all those listed on the New York Stock Exchange for his portfolio. He began with a single security and added securities one by one until a total of 20...

-

What are the advantages of deploying multicast routing protocols like PIM and IGMP in multimedia streaming applications, and how do they optimize bandwidth utilization and reduce network congestion ?

-

2. (10 points) Describe in a few words what the algorithm Foo does and what the algorithm Bar does. Analyze the worst-case running time of each algorithm and express it using "Big-Oh" notation....

-

Let x(t) = u(t+2)-u(t-1) where u(t) = < [1, t>0 0,t <0 (unit step signal) and h(t)=e'u(-t+1). a) Sketch x(t) and h(t). Label all your axes. b) Calculate the convolution y(t) = x(t)* h(t). Simplify...

Study smarter with the SolutionInn App