Using the information for Vision, Inc., in SE4, SE5, and SE9, compute the price/earnings (P/E) ratio and

Question:

Using the information for Vision, Inc., in SE4, SE5, and SE9, compute the price/earnings (P/E) ratio and dividend yield for 2013 and 2014. The company had 10,000 shares of common stock outstanding in both years. The price of Vision’s common stock was $60 in 2013 and $40 in 2014. Comment on the results. (Round to one decimal place.)

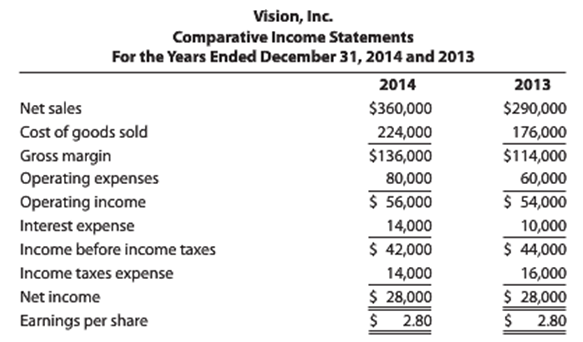

In SE4, Vision, Inc.’s comparative income statements follow. Compute the amount and percentage changes for the income statements, and comment on the changes from 2013 to 2014. (Round the percentage changes to one decimal place.)

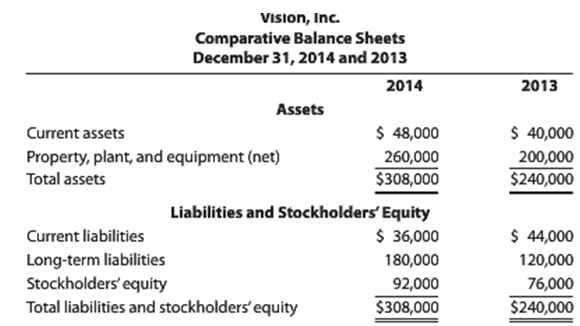

In SE5, Vision, Inc.’s comparative balance sheets follow. Prepare common-size statements and comment on the changes from 2013 to 2014. (Round to one decimal place.)

In SE9, Using the information for Vision, Inc., in SE4, SE5, and SE7, compute the cash flow yield, cash flows to sales, cash flows to assets, and free cash flow for 2013 and 2014. Net cash flows from operating activities were $42,000 in 2013 and $32,000 in 2014. Net capital expenditures were $60,000 in 2013 and $80,000 in 2014. Cash dividends were $12,000 in both years. Comment on the results. (Round to one decimal place.)

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Principles of Accounting

ISBN: 978-1133626985

12th edition

Authors: Belverd E. Needles, Marian Powers and Susan V. Crosson