Vasquez Corporation is considering investing in two different projects. It could invest in both, neither, or just

Question:

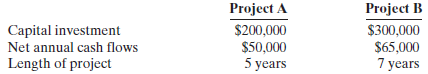

Vasquez Corporation is considering investing in two different projects. It could invest in both, neither, or just one of the projects. The forecasts for the projects are as follows.

The minimum rate of return acceptable to Vasquez is 10%.

Instructions

(a) Compute the net present value of the two projects.

(b) What capital budgeting decision should Vasquez make?

(c) Project A could be modified. By spending $20,000 more initially, the net annual cash flows could be increased by $10,000 per year. Would this change Vasquez’s decision?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Capital Budgeting

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted: