Vespars senior management team was poised to undertake the clean-coal power plants when they received a call

Question:

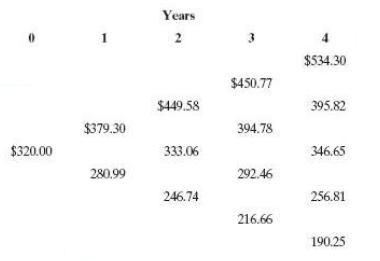

Vespar’s senior management team was poised to undertake the clean-coal power plants when they received a call from the chief engineer for the contractor who had been selected to build the initial plant. The engineer had the following proposed change to the plan: Instead of building two power plants each in years 1 and 2, the engineer suggested that the firm consider building only one plant per year and that additional funds be spent on R& D so that the learning that was expected to be accomplished by the building of multiple plants could be accomplished. The cost of plants plus the increased cost of R& D in years 1 and 2 would rise to $ 400 million and $ 385 million, respectively. Vespar’s management found the proposal intriguing and decided to revisit the economic analysis based on the reduced number of plants and higher total cost per plant. When Vespar’s financial analyst in charge of the original strategy evaluation was told of the need to reanalyze the strategy, he noted that this was probably a good idea because of recent events in the energy market. In fact, he felt that the volatility of the coal-fired strategy was substantially higher than when the original analysis was done. He estimated that the present values of the individual plants ($ millions) built over the next four years would now be as follows:

All the other information regarding the strategy remains the same except that the risk-neutral probability of a positive shift in the value of a new plant is now estimated to be 46.26%. (The actual probabilities remain 50-50.) The decision tree above assumes an up factor of 1.1853 and a down factor of .8781

a. What expected value of the investment strategy in which the abandonment option is ignored and all the plants are built, regardless of their NPV? For the purpose of this analysis, assume that the appropriate discount rate for the strategy is 13.77%.

b. What is the expected value of the investment strategy in which the option to aban-don is exercised optimally?

c. How much more can the plants cost in years 1 and 2 before the revised strategy is no longer preferred to the initial strategy? Assume that the same cost inflation factor applies to each plant in years 1 and 2 and that the net present value lattice applies.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Valuation The Art and Science of Corporate Investment Decisions

ISBN: 978-0133479522

3rd edition

Authors: Sheridan Titman, John D. Martin