Victoria Goldman is a financial advisor who manages money for high net worth individuals. For a particular

Question:

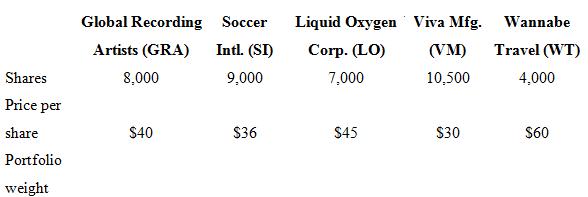

Victoria Goldman is a financial advisor who manages money for high net worth individuals. For a particular client, Victoria recommends the following portfolio of stocks.

a. Calculate the portfolio weights implied by Ms. Goldman’s recommendations. What fraction of the portfolio is invested in GRA and SI combined?

b. Suppose that the client purchases the stocks suggested by Ms. Goldman, and a year later the prices of the five stocks are as follows: GRA($60), SI($50), LO($38), VM($20), WT($50). Calculate the portfolio weights at the end of the year. Now what fraction of the portfolio is held in GRA and SI combined?

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction to Corporate Finance What Companies Do

ISBN: 978-1111222284

3rd edition

Authors: John Graham, Scott Smart

Question Posted: